Operation & Maintenance Subgroup

Operation and maintenance is one of the long term opportunity areas attached to the development of offshore wind in Scotland.

Cables are one of the critical components for any offshore wind farm. Our new specialist Cables Subgroup launched this month (Jan 2023) aims to showcase our members capabilities, products and services covering the manufacture, supply, installation and repair of both subsea and onshore cables.

Scotland is also one of the leading markets for floating offshore wind, which will require flexible, or what is known as dynamic cables, to connect floating turbine and substation platforms to each other and to the shore.

Oil and Gas Sector Experience

Many of our members have transitioned or diversified from Scotland's oil and gas sector where the knowledge of riser and umbilical technologies for floating oil and gas platforms, or FPSO* vessels, is directly applicable to floating wind.

This includes companies who manufacture dynamic cables for the oil an gas industry as well as members with expertise in cables installation, buoyancy and floatation systems.

Innovation

Our members are developing new technologies for the floating wind market as Scotland will see up to 17GW of floating wind delivered in the next decade. Many cable related challenges still need to be overcome to ensure that floating wind's cost reduction pathway stays on track to deliver parity with fixed wind by 2030. These include new methods of connecting and disconnecting dynamic cables, cable protection systems, carousel designs, monitoring systems, higher voltage array cables, dynamic export cables and new splicing and repair systems.

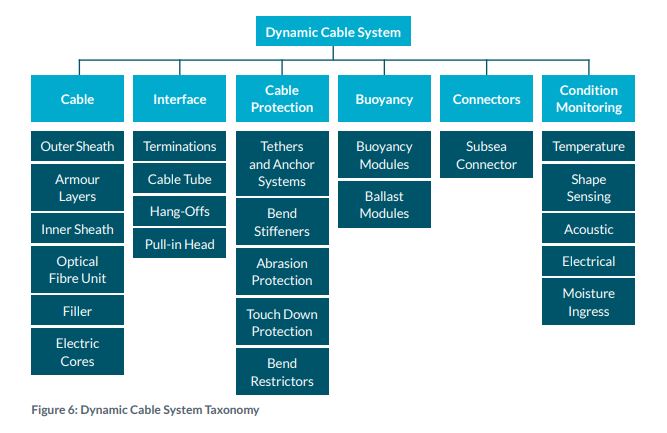

One of our members, the ORE Catapult, has produced a useful graphic on the taxonomy of dynamic cables which shows all of the elements involved in dynamic cables. Our Cable Subgroup contains members who cover almost every element shown in the diagram. The graphic is from their report 'Dynamic Cables and Ancillary Systems - Market Projections' and can be downloaded using he button below.

ORE Catapult report on 'Dynamic Cables and Ancillary Systems - Market Projections (PDF format)

The UK increased its offshore wind target from 40GW to 50GW in April 2022 with the advent of the British Energy Security Strategy. In order to ensure that this target was met, it was necessary to develop a plan to connect all of this wind power to the UK grid. Besides looking at the usual type of radial, wind farm to mainland grid connections this new plan explored options to interconnect offshore wind farms by subsea cables and to increase the connectivity between Scotland and England with a number of new HVDC subsea connections.

Holistic Network Design (HND)

This plan sets out the scale of the infrastructure and expenditure needed to connect up to 23GW of offshore wind in the UK by 2030. In Scotland this will see 12.5GW of offshore wind, including up to 11GW of ScotWind projects, connected to the grid by 2030 creating a significant market for subsea cables for not only connecting up to eight wind farms but also by delivering the four new East Coast Scotland-England HVDC subsea interconnectors, or Eastern Green Links. It also includes a number of new multi-terminal HVDC connections:

This represents an excellent series of supply chain opportunities for our Cables Subgroup. Phase 2 of the HND is expected at the end of March 2023 which will aim to show how more of the ScotWind projects will be connected to the grid.

A presentation on the impact of the Holistic Network Design (Phase 1) in Scotland can be downloaded using the button below. This and the above information will be updated once the HND Phase 2 plan is released.

Nationalgrid ESO have also produced a useful interactive map showing each of the news connections proposed under the HND covering all the offshore projects as well as all of the onshore reinforcements required. It can be view using this link. Interactive Map on Nationalgrid ESO web site

Holistic Network Design For 2030 In Scotland (DeepWind PDF presentation)

As the global offshore wind market gains momentum the need for export and array cables is growing exponentially. A recent Renewables UK (RUK) report from November last year, their 'Offshore Wind Project Intelligence Report – Cables Edition', shows a prediction for a six fold increase in demand by 2030.

The graphs on the left, taken from this RUK report, shows the figures in kilometres for array cables across the different regions. It can be seen that while East Asia currently has the largest market share per annum this changes towards the latter part of the decade with Northern Europe dominating the annual kilometres installed figures.

The graph does not differentiate between static and dynamic cables but the vast majority will be static cables due to the low installed capacity world wide for floating wind. With two floating wind projects already operational, Scotland is responsible for a large percentage of the currently deployed dynamic array cables.

The same pattern is repeated when looking at the export cable market as shown on the next graph on the right. One reason for the sharp increase in demand for both types of cable is the number of projects being delivered. Across North Europe another factor is also contributing to the increase in demand i.e. the length of the export cables. As countries in Northern Europe use up their near to shore sites the projects are moving further offshore. Scale is another factor, single projects are getting larger and now need multiple connections to shore to deliver the increased power and for security of supply i.e. redundancy.

Scotland is a good example of this process with ScotWind leasing round projects on the East Coast now with an average distance offshore of 65km. Although for ScotWind this has an additional challenge as 75% of these East Coast projects are for floating wind with a requirement for longer length dynamic array cables (due to the water depth) as well as dynamic export cable sections.

Scotland also has one of the best examples of what is happening with project scale. SSE Renewables planned Berwick Bank project which, at 4.1GW, will be the largest offshore wind farm in the UK, will have up to 10 Offshore Substation Platforms (OSP), 1,225km of array cables, 94km of interconnectors (connecting the OSPs) and 12 exports cables with a total length of 1,072km.

With the Moray West, Inch Cape, Seagreen 1a and 20 ScotWind projects still to come as well as the planned offshore grid and Scotland-England interconnectors in the Holistic Network Design Scotland is one of the main target markets for HVDC and HVAC cable companies worldwide. Our Cables Subgroup member have this market on their doorstep.

The Carbon Trust and the Offshore Renewable Energy Catapult are both delivering innovation programmes which include cable technologies. Below are two reports looking at the subject of dynamic cables for floating offshore wind.

The Carbon Trust's Offshore Wind Accelerator (OWA) has published this report looking at the next development in voltage levels for array cables

'Unlocking the next generation of offshore wind: step change to 132kV array systems'

The OWA High Voltage Array Systems project has produced this study looking at the the optimal voltage level for next generation array cables and how the industry can transition most effectively to this new standard capacity.

Use the link button below to download the report.

The Offshore Renewable Energy Catapult and our very own Cables Subgroup Co-chair, 2H Offshore partnered to produce this document, 'Dynamic Cable Technology Qualification Framework and Case Studies'.

This is Phase 1 of the ORE Catapult's Floating Offshore Wind Dynamic Cabling Systems –Technology Development and Qualification Programme which seeks to help the development and validation of the cables technologies that will support the move towards large scale floating wind in a cost effective manner. Use the link button below to download the report.

List of Cables Subgroup Members

One of two new Subgroups for DeepWind in 2023. The Cables Subgroup has grown to155 members and our Industry Co-chairs are Dr Qi Tang from NBO Orient Cables and Liam Moore of 2H Offshore Engineering. Companies wishing to join this newer one of our subgroups can submit a DeepWind membership application and select the Cables Subgroup in the subgroup section. Existing DeepWind members can just ask to be added to the subgroup.

Explore our other specialist subgroups using the links below

Operation and maintenance is one of the long term opportunity areas attached to the development of offshore wind in Scotland.

Our Power2X Subgroup is involved in looking at alternate products from offshore wind besides the normal electricity to the grid business model.

This subgroup brings together the supply chain elements that make up the major components of floating wind.

From early stage development surveys to all aspects of aerial, surface and subsea inspections, this subgroup covers it all.