The UK grid was planned and laid out in an era of coal and gas fired power stations. This was usually in a radial hub and spoke arrangement with central power production delivered out to the periphery. This was very evident in Scotland where power stations were situated in the industrial and high population density areas in the Central Belt and East Coast. Transmission and distribution networks then fed this power out to more rural and remote areas including the Scottish Islands.

Today the rise of renewable power, and offshore wind in particular, has turned this situation completely on its head. Most of the best wind resources are on the periphery and, away from the East Coast area, mostly in areas of low population density. In order to service this new paradigm we need to design grid infrastructure that will bring electricity from offshore wind farms to the centres of demand in the UK.

Government and industry are now working together to solve this new challenge and re-purpose the UK grid infrastructure for the 21st Century. In 2020 the Department for Business, Energy and Industrial Strategy (BEIS) launched the Offshore Transmission Network Review (OTNR). This has now resulted in the Holistic Network Design (HND July 22) which is aimed at adding 23GW of offshore wind to the UK system by 2030, 12.5GW of which is in Scotland.

Scotland has been a major exporter of energy for decades. Not just from its oil and gas fields of the last 50 years but by also exporting power from its onshore wind and hydro power facilities during peak periods. Scotland's ability to export green power is about to increase exponentially over the next 10 years with almost 50GW of wind power in its project pipeline. The bulk of this new production, 38GW, will come from offshore wind.

Holistic Network Design and beyond 2030 reports

The HND project consists of both onshore and offshore upgrades and extensions. It includes HVAC and HVDC elements as well as new multi-terminal technology HVDC systems. The list of Scottish projects in scope for HND is set out below and although we await a Detailed Network Design (DND) as a follow up to HND this list represents the ScotWind projects most likely to connect to the grid before 2030. An updated HND update report (Beyond 2030) has now been published. It contains planned connections looking to add all the remaining ScotWind projects, along with some INTOG projects, to the system.

The Beyond 2030 report does not contain any connection dates and the developers are now awaiting the outcome of a complete overhaul of the grid connection process to enable new connection dates to be supplied by the National Energy Systems Operator (NESO). These new connection dates are expected to be announced early in 2026.

|

SITE |

DEVELOPERS |

CAPACITY |

|

1 |

BP and EnBW |

1,500MW |

|

3 |

Renantis and BlueFloat Energy |

1,200MW |

|

9 |

Ocean Winds |

1,500MW |

|

11 |

ScottishPower Renewables |

1,500MW |

|

13 |

RIDG, Corio Generation and TotalEnergies |

2,250MW |

|

16 |

Northland Power and ESB |

740MW |

|

17 |

ScottishPower Renewables |

2,000MW |

|

PA-2 |

SSE Renewables (Berwick Bank) |

1,800MW |

|

Total |

12,490MW |

Please note that the HND is not proposing to connect the full capacity of some of the above projects but just their initial phases as shown in the capacity figures in the list.

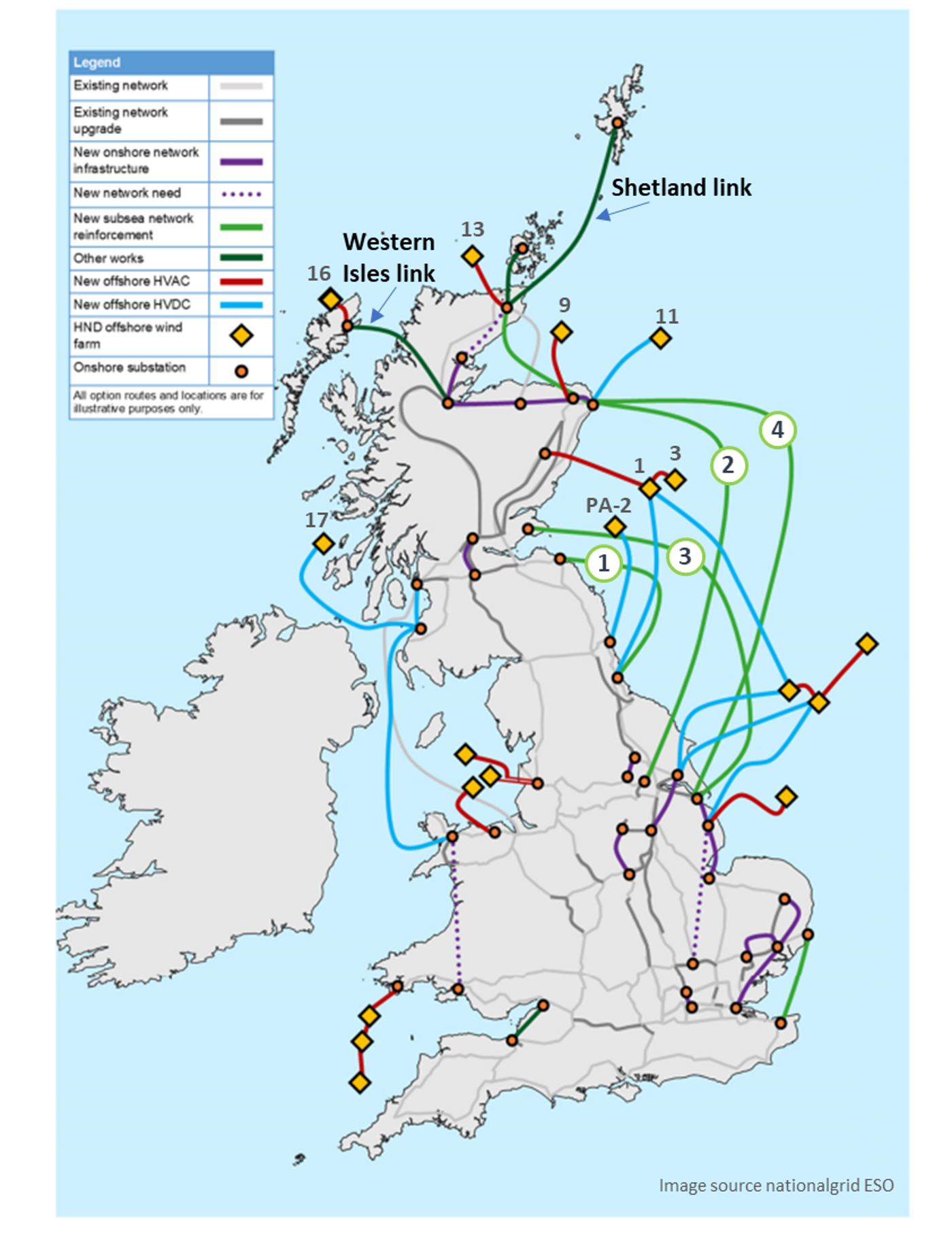

The map below shows the position of all the offshore wind projects in the list, the newly proposed 1.8GW HVDC Western Isles link along with the HVDC Shetland link which is currently under construction. The four proposed HVDC Eastern Links are also numbered on the map.

These are:

Eastern Green Link 1 – Torness to Hawthorn Pit (196km)

Eastern Green Link 2 – Peterhead to Drax (505km)

Eastern Green Link 3 – Peterhead to South Humber (550km)

Eastern Green Link 4 – Kinghorn, Fife to South Humber (500km)

With an overall cost estimate of between £12.5bn-£14.5bn, these links will help speed up the delivery of other ScotWind projects.

Holistic Network Design map

*hover / touch to see more information

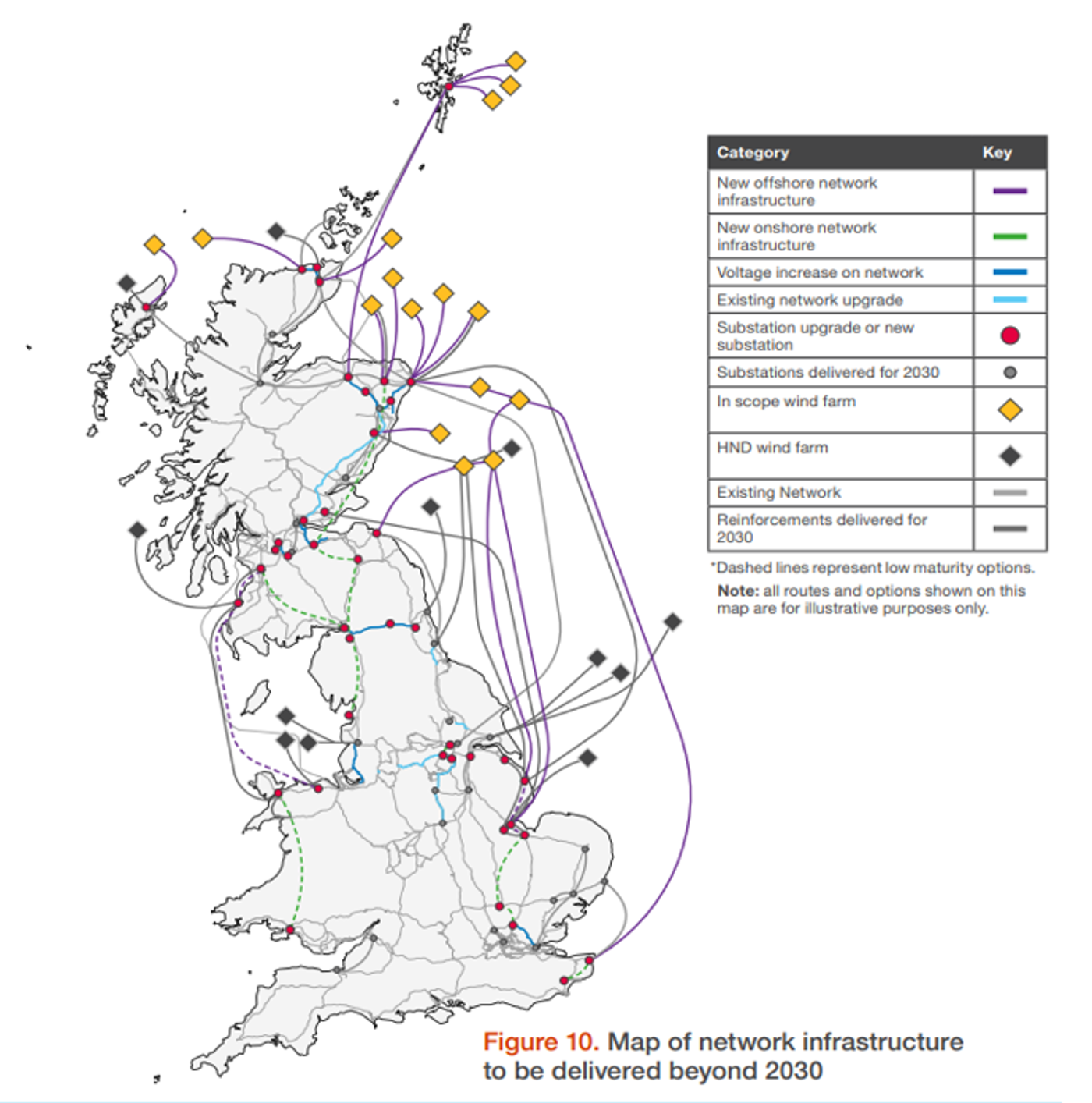

The Beyond 2030 planned connections are shown in the map below. These are the NESO preferred options to connect the rest of the ScotWind round lease sites. NESO and OFGEM are currently overhauling the rules for the UK's grid queue with the intention of speeding up the delivery of 'shovel ready' projects and some of these sites may now see connection dates coming forward to help the UK reach its 2030 target of between 43GW-50GW of operational offshore wind.

Beyond 2030 - NESO preferred options

*hover / touch to see more information

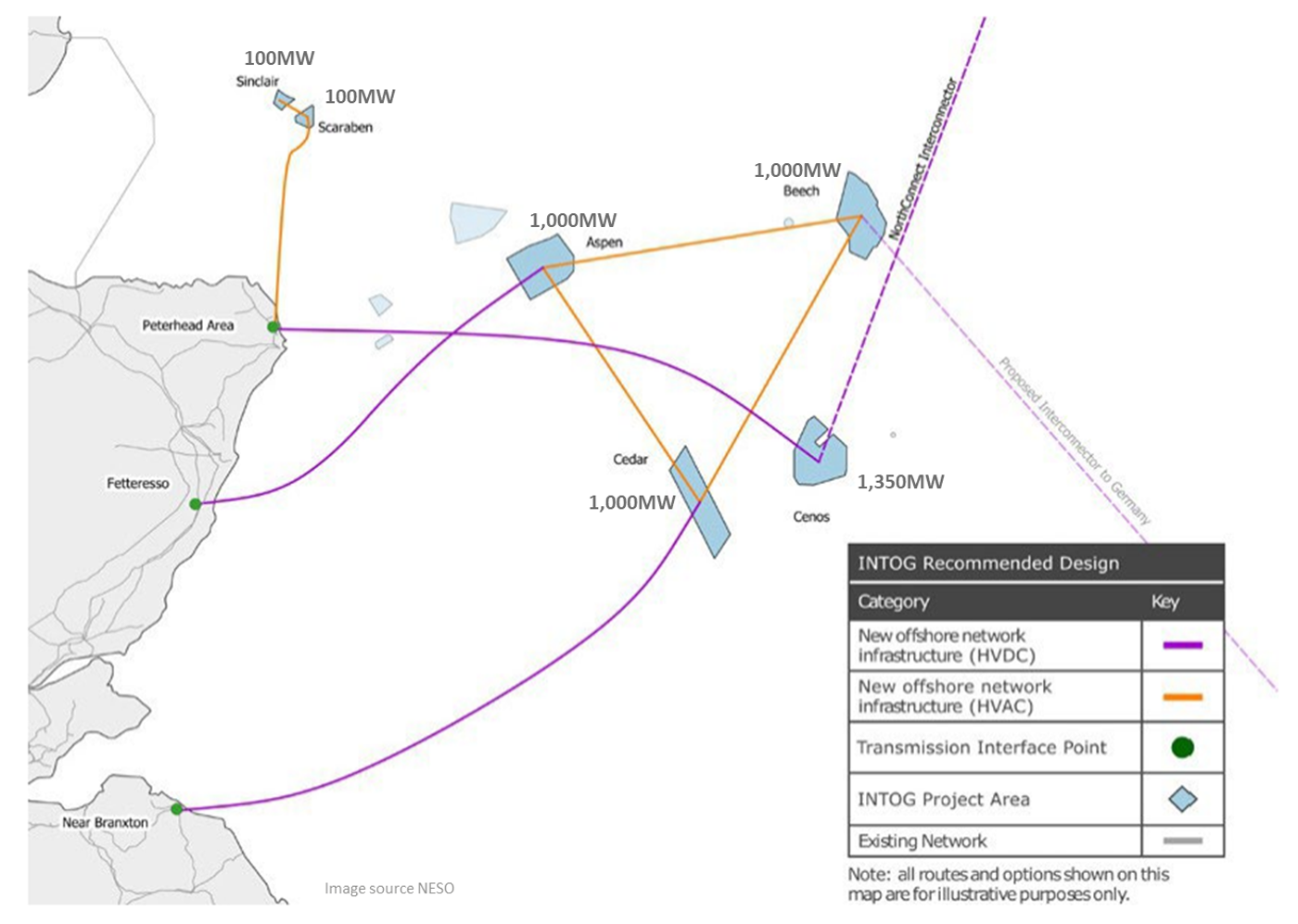

The final round of connections are for the INTOG East Coast sites and the map below now shows NESO's preferred approach to connect these sites. This includes options to connect potential interconnectors to Norway and Germany to some of these INTOG projects as part of a new Offshore Hybrid Assets (OHA) approach to offshore grid infrastructure utilising multi-terminal HVDC technology. This technology has already been deployed commercially for the first time in Europe by SSE Networks for their Shetland HVDC Link and Caithness-Moray HVDC Link inn the North of Scotland.

INTOG East Coast - NESO preferred options

*hover / touch to see more information

REMA Update: implications for offshore wind in Scotland

The UK Government has published an update to the Review of Electricity Market Arrangements (REMA), outlining its decision to pursue a Reformed National Market approach. This includes retaining a single GB-wide wholesale electricity market, rather than introducing zonal pricing.

Transmission Charging Reform

A key area of focus in the REMA update is reforming Transmission Network Use of System (TNUoS) charges and connection charging regimes. These charges currently vary depending on the location of generation assets, with projects in northern Scotland facing significantly higher costs than those in southern England. The update notes that this disparity can impact investment decisions and project viability.

The UK Government has committed to reviewing the purpose and structure of these charges, with the aim of improving predictability and aligning them with long-term planning. Changes are expected to be implemented by 2029, with further detail to be published later in 2025.

Strategic Spatial Energy Planning

The update introduces the Strategic Spatial Energy Plan (SSEP), a long-term planning tool designed to identify optimal locations, capacities, and timings for electricity and hydrogen generation and storage across Great Britain. The first version of the SSEP is expected in 2026 and will inform the Centralised Strategic Network Plan (CSNP), due in 2027. These plans are intended to support efficient infrastructure siting and reduce constraint costs.

Constraint Management and Operational Efficiency

The REMA update also outlines measures to improve operational efficiency and reduce constraint costs, including reforms to the balancing mechanism and the development of the Constraints Collaboration Project. These initiatives aim to enable more flexible participation in grid balancing and encourage co-location of energy-intensive industries near generation sources.